The Specialty Equipment Market Association (SEMA), whose membership is focused on the performance and accessories segment of the automotive aftermarket, says that while it supports the move for fair and equitable trade, the Trump administration’s tariff strategy may not be meeting that goal.

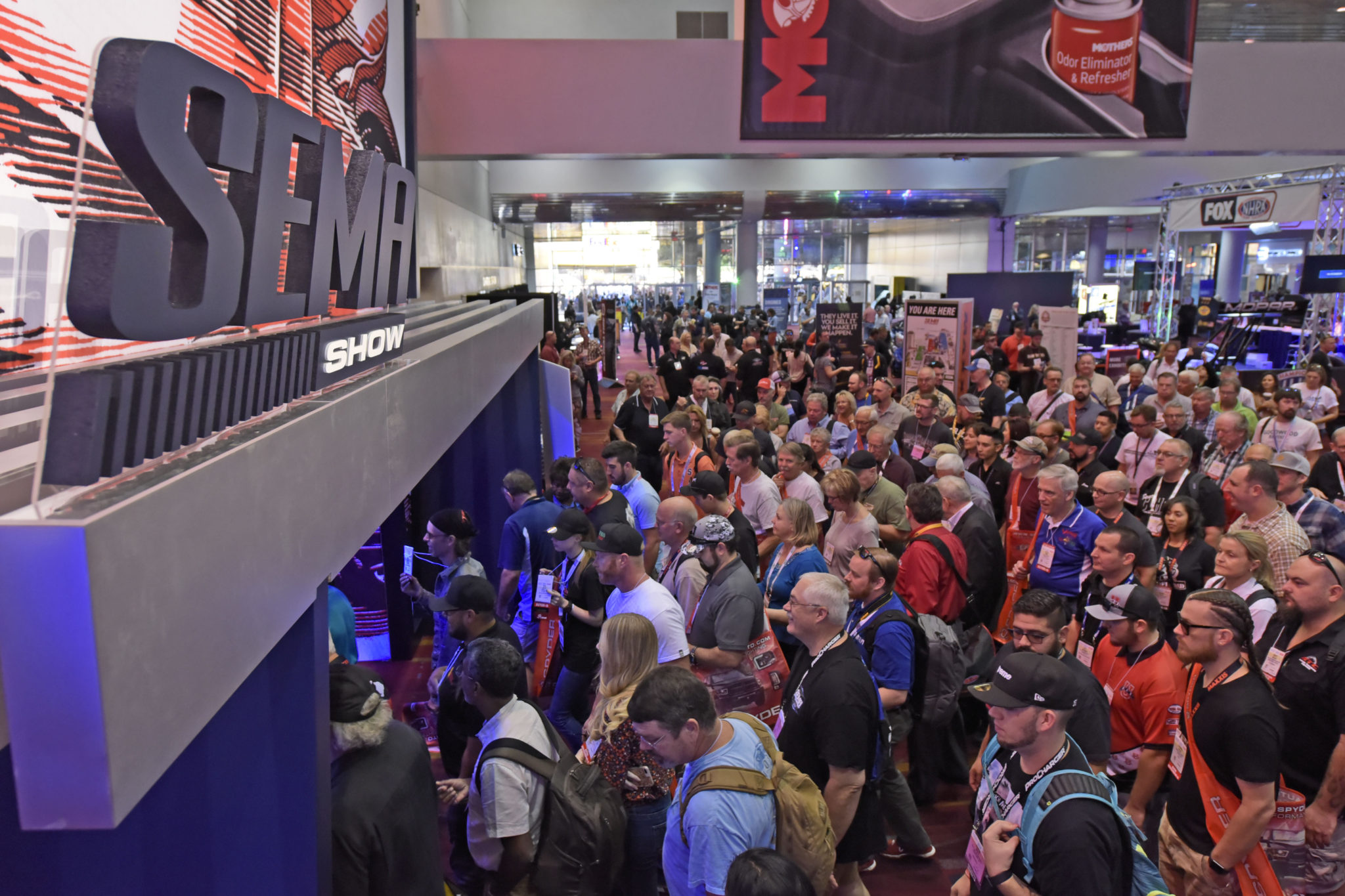

SEMA, which operates the annual SEMA show in Las Vegas, says that U.S. companies paid $6.2 billion in tariffs during October 2018. This includes $2.8 billion for tariffs imposed by the Trump Administration in recent months that are intended to encourage foreign nations to negotiate new trade agreements with the U.S.

U.S. imports subject to the new tariffs only declined by 0.6 % in October since companies were likely stockpiling foreign goods, says SEMA.

“Nevertheless, exports subject to foreign retaliation fell 37%. While SEMA supports the Administration’s efforts to create fair trade and protect intellectual property rights, the Association remains concerned that tariffs are not accomplishing this shared objective.”

SEMA also offered a detailed analysis on the current state of affairs in the U.S.:

There are currently two trade actions spurring tariffs on imported auto-related goods, and a third in the works:

1. Steel/Aluminum: The U.S. government has imposed global tariffs on steel (25%) and aluminum (10%). Most of the tariffs began June 1. To date, only Argentina, Australia, Brazil and South Korea have trade agreements exempting them from the tariffs. The tariffs apply to processed raw materials (steel/aluminum plate, sheets, bars, etc.), but not finished products (e.g., wheels, exhausts, etc.).

U.S.-based companies are eligible for a one-year tariff exclusion if they can demonstrate that the foreign-produced material is not made in the United States in a reasonably available quantity or satisfactory quality. More than 40,000 company exclusion requests have been received to date.

2. Made in China Products: 25% tariffs have been imposed on $50 billion worth of Chinese imports, and 10% tariffs on another $200 billion worth of goods began September 24. The United States Trade Representative (USTR) has been directed to identify another $267 billion in Chinese imports that could be subject to tariffs. The tariffs are an attempt to lower the U.S./China trade deficit and deter cyber theft of intellectual property by Chinese government and companies. The imposition dates for the $50 billion tariffs were staggered:July 6 for $34 billion and August 23 for $16 billion.

- $34 billion: 818 Harmonized Tariff Code listings,including miscellaneous metal and rubber parts for auto equipment, machinery,tools, measurement and medical devices.

- $16 billion: 279 Harmonized Tariff Code listings, including many types of plastics.

- $200 billion: 10% tariffs on another $200 billion worth of imported Chinese products began September 24, 2018. The tariffs were scheduled to increase to 25% January 1, 2019, if the United States and China have not resolved their ongoing trade disputes, but the deadline has been extended to at least March 1, 2019. The complete list of products covers 5,745 full or partial lines of the original 6,031 tariff lines proposed in July. The list continues to include many auto parts, from engines and metal fasteners, to tires, steering wheel components, rubber gaskets, transmission belts, brake pads, windshields and suspension springs. Read SEMA’s comments opposing the tariffs.

3. Imported Autos/Auto Parts: At the request of President Trump, the U.S. Department of Commerce (DOC) is investigating whether to impose tariffs on imported automobiles and auto parts if it is found that they pose a threat to America’s national security (manufacturing base). The DOC will report its findings and recommendations for presidential actions, if any, by February. President Trump has stated that he is considering global tariffs of 20% to 25%. The DOC investigation applies to all types of cars and parts, including new cars, classic cars, OEM parts and specialty auto parts. The move would directly affect all U.S. automakers and parts suppliers who use imported components, as well as importers of cars, trucks and SUVs. The tariffs could be imposed globally, although the United States and EU have pledged not to pursue tariffs while negotiations to resolve trade disputes are ongoing. SEMA testified at a DOC hearing July 19, 2018. Read SEMA’s written comments

Auto/Auto Parts Coalition: Eight major trade associations have formed the “Driving American Jobs” Coalition to oppose potential tariffs on imported motor vehicles and auto parts. It includes SEMA and represents the broad scope of the auto industry, from automakers and dealers to parts manufacturers, distributors, retailers and service providers. The Coalition is united in opposing the referenced tariffs as being counterproductive and threatening American companies, workers and consumers. The message to the president and lawmakers has been to pursue trade infringements in a fashion that does not inflict unintended economic harm.

For more information, contact Stuart Gosswein at stuartg@sema.org.

0 Comments