Will the rise of electronic ride control systems fundamentally change the way these systems are serviced and sold?

By Martha Uniacke Breen

Electronic ride control systems were first introduced almost twenty years ago, but since their first (sometimes finicky) introduction, they’ve become one of modern vehicles’ most highly sophisticated systems. And as EVs and BEVs appear more frequently in service provider bays, these systems will become a fact of life sooner than you probably think..

In real-world terms, what kind of an effect will this have on the aftermarket, in the near- and medium-term? We asked to several leading ride control distributors what effect they see the approaching “electric wave” having on ride control sales and inventories.

Karen Shulhan of DRiV, which distributes the Monroe and Tenneco brands, observes, “This new technology will require new technical training that is more vehicle-specific and oriented to identify and resolve technical issues. Additionally, correct installation procedures will be critical for success.”

Andrew Castleman of KYB agrees. “As OEs continue to adapt new technologies and more sophisticated systems, it’s extremely important for the aftermarket to provide the guidance and education to support those products. Distributors and wholesalers should look to manufacturers that can provide training or online support for these advanced technologies. The aftermarket must be able to not only supply the components, but also provide the knowledge to service providers on how to diagnose and maintain them so consumers don’t have to go to the OE dealer for service.”

As adoption by OEs of these systems becomes more widespread, the impact on the aftermarket may take a variety of paths. Gabriel’s Jennifer Cameron points out that the selection of replacement offerings should also include non-electronic alternatives, which may be attractive to some aftermarket customers for economic reasons. “The rise in high-tech, electronically controlled ride control systems means that aftermarket distributors and wholesalers are going to have to offer parts for replacement,” she explains. “Non-electronically controlled ride control replacements are available from Gabriel for aftermarket distributors and wholesalers, since the majority of high-tech electronic replacement parts are too expensive for the average consumer, resulting in many consumers seeking more reasonably priced alternatives – like those from Gabriel.”

KYB’s Castleman sees it as an opportunity for expansion within the aftermarket. “New technologies have always been a part of the automotive industry,” he says. “There will be some impact on the product mix that distributors and wholesalers carry, but the majority of the vehicles being produced, and those planned for the near future, will continue to utilize similar hydraulic shocks and struts as used today. The cost and weight of many of the electronic systems is prohibitive for the OE models, where costs and improved MPG are a concern. Thus, the effect on the overall VIO will be limited.”

Shulhan believes, “As the vehicles begin to reach service age, we anticipate broad aftermarket adoption worldwide, given growth in OE electronic suspensions, particularly in hybrid and electric vehicles. The importance of the proper performance of shock absorbers, steering parts and brake parts will remain the same, although noise-related complaints caused by worn parts could rise due to increased awareness among customers driving EVs. This could benefit the aftermarket.”

How can distributors and jobbers best prepare to serve their service provider customers in this service category?

“The key is open communication and feedback from the service providers they support,” says Castleman. “What all suppliers need, especially with new technology, is to understand the replacement rates. The big question is always, ‘How long will these new high-tech components last?’

“No one truly knows how a system will perform until it’s subjected to consumer driving habits,” he continues. “Some components may wear quicker than others and need replacing sooner. Service providers are on the front lines and can provide their channel partners with feedback on what they’re seeing in the marketplace. Manufacturers understand how to make things, and it’s critical they receive feedback from the field so they can provide the proper parts to support their partners.”

According to DRiV’s Shulhan, the solution, as in every other period of transition with a new technology, is in thorough and timely training. “In many respects, aftermarket providers had similar concerns during earlier periods of transition, including the introductions of electronic ignition systems, fuel injection, antilock braking, and Macpherson strut suspensions. In each of these cases, the timely availability of in-depth training helped parts and service providers manage these shifts while growing their businesses.”

Shulhan points to Garage Gurus, Tenneco’s training and technical support services exclusively for the aftermarket, explaining that it already developing training resources, specifically related to Teneco’s products, to help aftermarket businesses address the emerging service opportunities represented in high-tech ride control systems. There are also a number of excellent training programs available offered by sister brand Monroe.

Our spokespeople also suggested a number of other changes of interest in the ride control market worth noting. Cameron suggests that offering additional options to standard OE replacement ride control is key. “Many consumers who wish to upgrade their OE ride control are looking for attractive appearance in performance options such as monotube, coil-over, and air shocks,” she points out. “Monotubes offer sporty handling, off-road control and occasional towing. For customers who need added payload or a boost in their ride height, coil-overs and air shocks are preferred.”

As Andrew Castleman observes, “One of the trends is the shift by manufacturers back to rear shocks; KYB has been telling our partners about this for years. In the past, OEs were focused on using strut assemblies on all four corners. However, because of weight and cost, the current trend is to move back to shocks in the rear. That’s good news for most of us in the industry, because shocks take up less shelf space and tend to cover more model years than struts.”

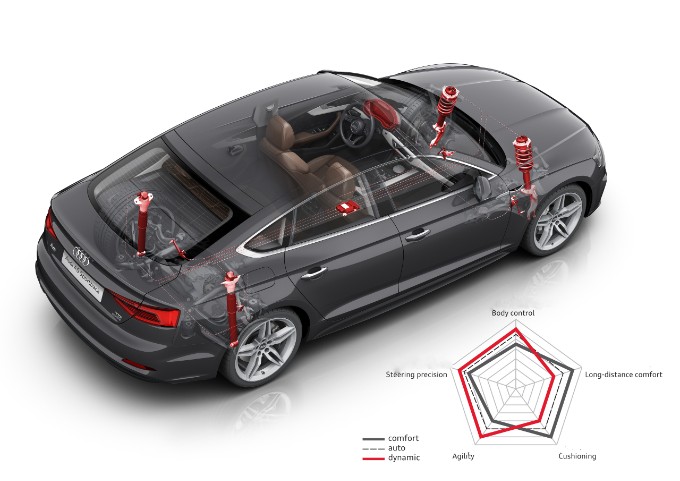

Adds Karen Shulhan, “Another trend is the growth in battery electric vehicles (BEVs), which is driving the adoption of electronic suspension systems, as OEMs address the unique performance requirements of electric powertrains. For example, our Monroe Intelligent Suspension CVSAe semi-active dampers include several design and construction features that extend load capacity and damping force tuning range for vehicles equipped with lithium-ion battery packs. The added weight of EV batteries can increase damping requirements in a variety of driving situations. CVSAe technology automatically applies added damping force in these situations to reduce body pitch, or “brake dive,” while maintaining outstanding ride comfort.”

The fact is that, in the near term, while these vehicles may not be coming into many aftermarket service bays that frequently right now, the pace at which they are being adopted by the driving public is accelerating. Being prepared with the right range of replacement products, along with adequate training and knowledge, will be key to staying ahead of what is bound to be a major shift within just a few short years.

0 Comments