O’Reilly Automotive, Inc., a leading retailer in the automotive aftermarket — and which acquired Canada’s Groupe Del Vasto in January 2024 — announced record revenue and earnings for its fourth quarter and full-year ended December 31, 2023.

The results represent 31 consecutive years of comparable store sales growth and record revenue and operating income for O’Reilly since becoming a public company in April of 1993.

“Our success in 2023 is a testament to our Team’s hard work, and as we look forward to 2024,” said Brad Beckham, O’Reilly’s Chief Executive Officer. “We remain absolutely confident in our Team’s ability to consistently execute our dual market strategy and provide the best customer service in the industry.

“Our Team has repeatedly proven their ability to aggressively gain market share and profitably grow our business, and we are extremely excited to welcome our new Canadian Team Members to the O’Reilly family, with the closing of the Groupe Del Vasto acquisition in January. O’Reilly’s experienced leadership is already working closely with our seasoned management team in Canada, and we look forward to capitalizing on the long-term profitable growth opportunities in our new markets as we extend our track record of profitable growth throughout North America.”

O’Reilly 4th Quarter Financial Results

“We are pleased to report another solid quarter, highlighted by a comparable store sales increase of 3.4%, on top of the very strong 9.0% comparable store sales increase Team O’Reilly delivered in the fourth quarter last year,” said Brad Beckham, O’Reilly’s Chief Executive Officer. “Our Team once again generated double-digit professional comparable store sales growth, while also successfully navigating the anticipated year-over-year pressure we experienced on the DIY side of our business, resulting from the extremely strong, weather-driven sales we produced in the fourth quarter of 2022. In total, our comparable store sales performance exceeded our expectations for the quarter, driven by Team O’Reilly’s relentless focus on providing the highest levels of service in the industry. We would like to express our appreciation to each of our over 90,000 Team Members for their unwavering commitment to going above and beyond for our customers each and every day.”

Sales for the fourth quarter ended December 31, 2023, increased $188 million, or 5%, to $3.83 billion from $3.64 billion for the same period one year ago. Gross profit for the fourth quarter increased 6% to $1.97 billion (or 51.3% of sales) from $1.85 billion (or 50.9% of sales) for the same period one year ago.

Figures in USD.

Selling, general and administrative expenses (“SG&A”) for the fourth quarter increased 7% to $1.25 billion (or 32.6% of sales) from $1.17 billion (or 32.2% of sales) for the same period one year ago. Operating income for the fourth quarter increased 5% to $719 million (or 18.8% of sales) from $682 million (or 18.7% of sales) for the same period one year ago.

Net income for the fourth quarter ended December 31, 2023, increased $24 million, or 5%, to $553 million (or 14.4% of sales) from $529 million (or 14.5% of sales) for the same period one year ago. Diluted earnings per common share for the fourth quarter increased 11% to $9.26 on 60 million shares versus $8.37 on 63 million shares for the same period one year ago.

O’Reilly Full-Year Financial Results

Beckham continued, “We delivered another year of exceptional, profitable growth, highlighted by a 7.9% increase in comparable store sales and a full-year diluted earnings per share increase of 15% to $38.47. I would like to congratulate our entire Team for their 31st consecutive year of annual comparable store sales growth and record earnings. 2023 was also a very successful expansion year for our Company, with the successful opening of 186 new stores, the growth of our store and distribution footprint into Puerto Rico, and the opening of a large, modern distribution center in Guadalajara, Mexico.”

- Sales for the year ended December 31, 2023, increased $1.40 billion, or 10%, to $15.81 billion from $14.41 billion for the same period one year ago.

- Gross profit for the year ended December 31, 2023, increased 10% to $8.10 billion (or 51.3% of sales) from $7.38 billion (or 51.2% of sales) for the same period one year ago.

- SG&A for the year ended December 31, 2023, increased 11% to $4.92 billion (or 31.1% of sales) from $4.43 billion (or 30.7% of sales) for the same period one year ago.

- Operating income for the year ended December 31, 2023, increased 8% to $3.19 billion (or 20.2% of sales) from $2.95 billion (or 20.5% of sales) for the same period one year ago.

- Net income for the year ended December 31, 2023, increased $174 million, or 8%, to $2.35 billion (or 14.8% of sales) from $2.17 billion (or 15.1% of sales) for the same period one year ago.

- Diluted earnings per common share for the year ended December 31, 2023, increased 15% to $38.47 on 61 million shares versus $33.44 on 65 million shares for the same period one year ago.

4th Quarter and Full-Year Comparable Store Sales Results

Comparable store sales are calculated based on the change in sales for U.S. stores open at least one year and exclude sales of specialty machinery, sales to independent parts stores, and sales to Team Members. Online sales for ship-to-home orders and pick-up-in-store orders for U.S. stores open at least one year are included in the comparable store sales calculation. Comparable store sales increased 3.4% for the fourth quarter ended December 31, 2023, on top of 9.0% for the same period one year ago. Comparable store sales increased 7.9% for the year ended December 31, 2023, on top of 6.4% for the same period one year ago.

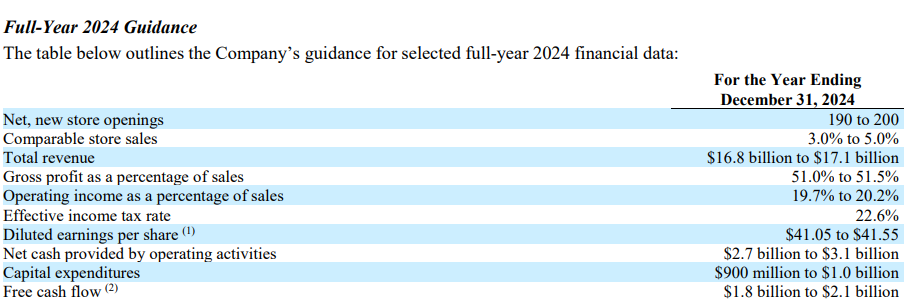

(1) Weighted-average shares outstanding, assuming dilution, used in the denominator of this calculation, includes share repurchases made by the Company through the date of this release.

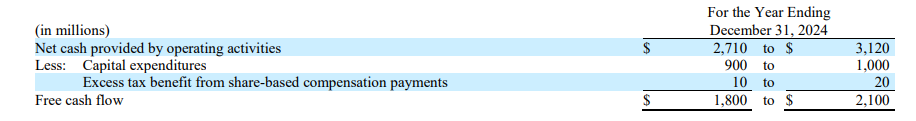

(2) Free cash flow is a non-GAAP financial measure. The table below reconciles Free cash flow guidance to Net cash provided by operating activities guidance, the most directly comparable GAAP financial measure:

About O’Reilly Automotive, Inc.

O’Reilly Automotive, Inc. was founded in 1957 by the O’Reilly family and is one of the largest specialty retailers of automotive aftermarket parts, tools, supplies, equipment, and accessories in the United States, serving both the do-it-yourself and professional service provider markets. Visit the Company’s website at www.OReillyAuto.com for additional information about O’Reilly, including access to online shopping and current promotions, store locations, hours and services, employment opportunities, and other programs. As of December 31, 2023, the Company operated 6,157 stores across 48 U.S. states, Puerto Rico, and Mexico.

As of the closling of its acquisition of all shares of Groupe Del Vasto, it added Vast-Auto Distribution’s two distribution centers and six satellite warehouses that support a network of 23 company-owned stores, hundreds of strategic independent partners, as well as a widespread service reach that extends to thousands of other independent jobber and professional customers across Eastern Canada.

0 Comments