The sector analysis of the Automotive Industries Association of Canada‘s most recent COVID-19 business impact survey reveals a growing positive outlook among aftermarket businesses in Canada, but perhaps surprisingly this is bolstered strongly by the significant increase in confidence from the collision repair sector.

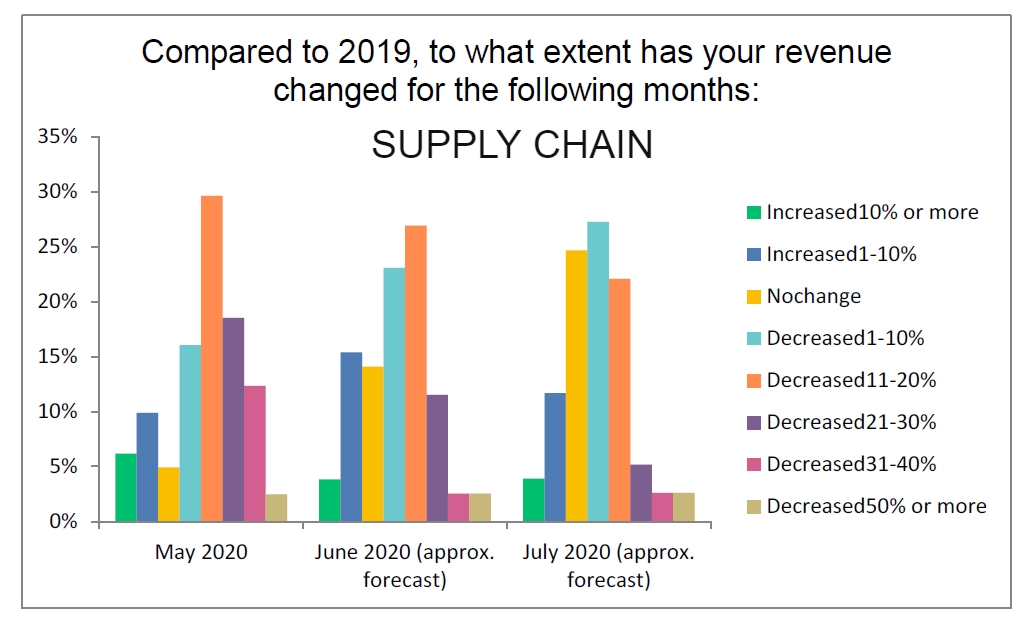

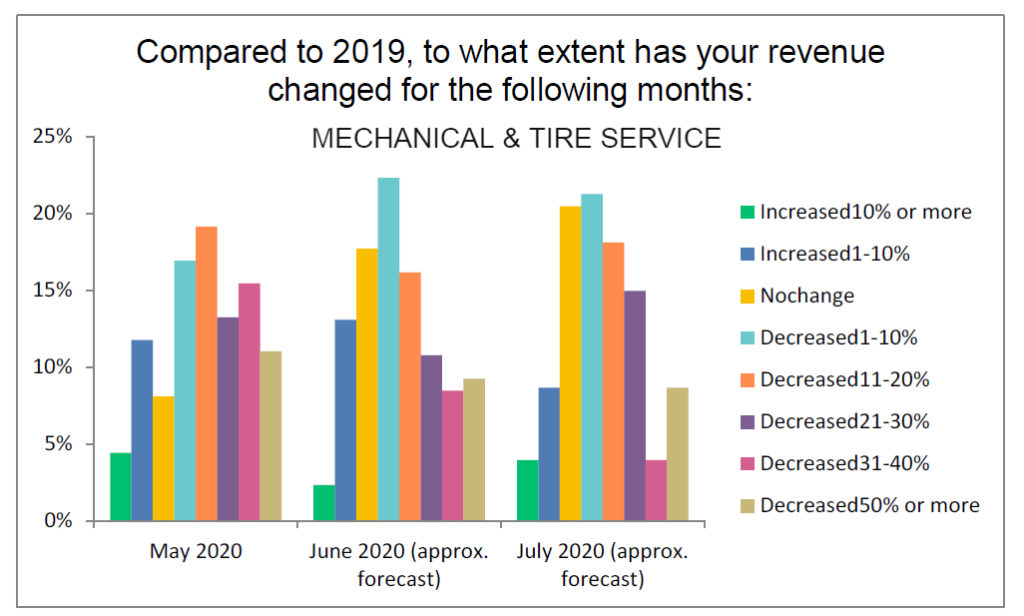

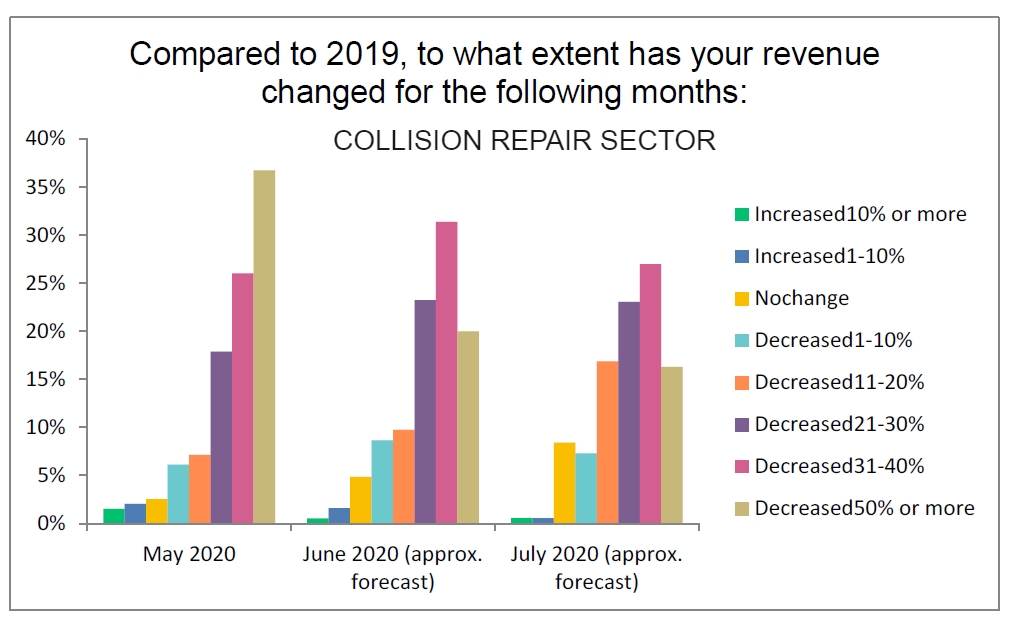

In comparison to as compared to the supply chain and service provider segments, that sector saw the most dramatic drop in both revenues and business confidence early in the economic shut down brought on by the COVID-19 pandemic response.

As economic activity has continue to improve it is the collision repair sector where the rebound is most stark, helping to explain the significant shift in the sentiments from respondents in that sector. The more moderated shift in the supply chain and service sectors, while definitely considerable, can be explained at least in part by the comparatively smaller declines that these two sectors saw.

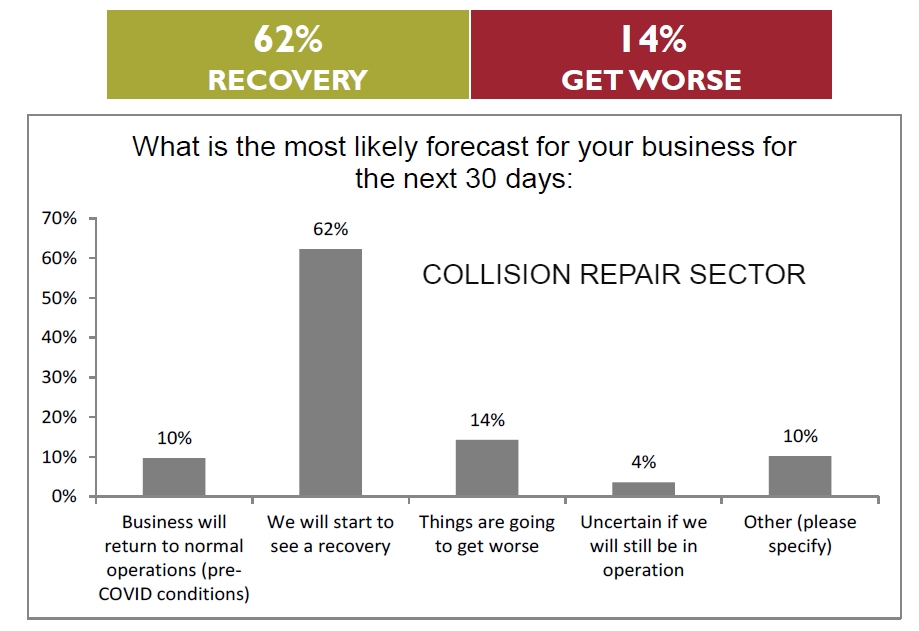

The collision repair sector, as mentioned, has seen the most dramatic about face in its outlook with 62% of respondents from that sector now firmly stating recovery is in the offing, and only 14% seeing things will get worse over the next 30 days. This is a 50 percentage point change in confidence levels.

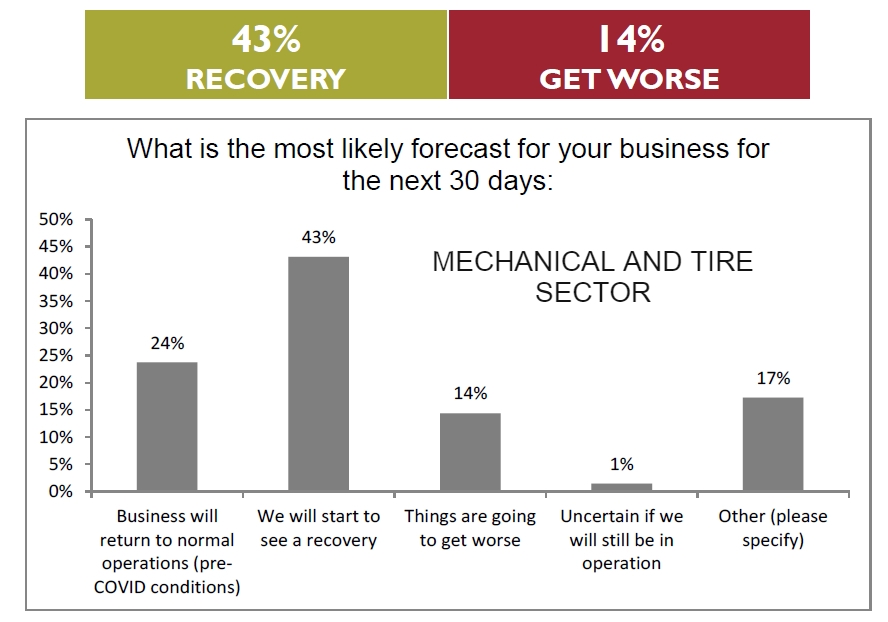

For the mechanical service sector only 43% are in the recovery camp with 14%, saying things might get worse.

Interestingly, though,24% of respondents said that business will return to normal operations in the next 30 days, some 17% of the qualitative responses In the mechanical sector still indicated a high level of uncertainty. “Most responses expressed that some areas of their business are picking up however they remain cautious and they’re thinking that operations will return to normal.”

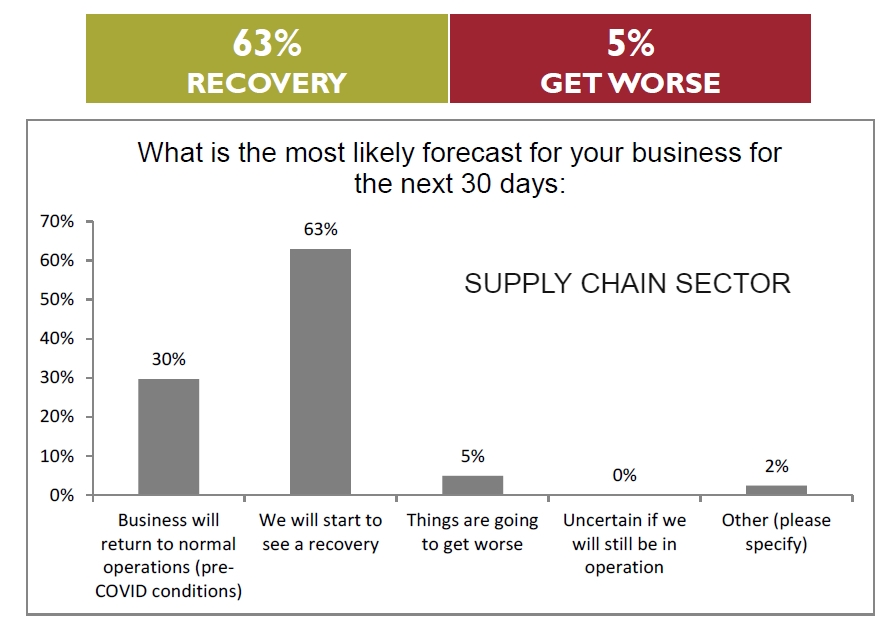

Among respondents from the supply chain there was very little change in the confidence level with 63% of businesses forecasting recovery while only 5% of respondents Indicated things would get worse. Some 30% of the respondents expected business to return to normal, pre-COVID conditions. The most significant shift among supply chain respondents was in the “things are going to get worse” category. In the first round of surveys 14% of businesses expected that things will get worse over the next 30 days, but in this current round the number has dropped To 5%.

The top three key concerns are shared by both the mechanical repair and collision repair sectors — economic recession at global, national, and provincial levels, the risk of a second outbreak of COVID-19, and consumers attitudes towards vehicle maintenance.

For the supply chain , the top two concerns are the same, but managing the stress of executives and staff was the number three concern. This area of concern was also highly ranked at the service sector but only as the number four and number five areas of concern for the collision repair and mechanical repair sectors respectively.

The complete COVID-19 Business Survey is available for download at www.aiacanada.com.

0 Comments