The Automotive Industries Association of Canada released the results of its second round of COVID-19 Business Impact survey, showing improving optimism and business performance, but with some lingering concerns.

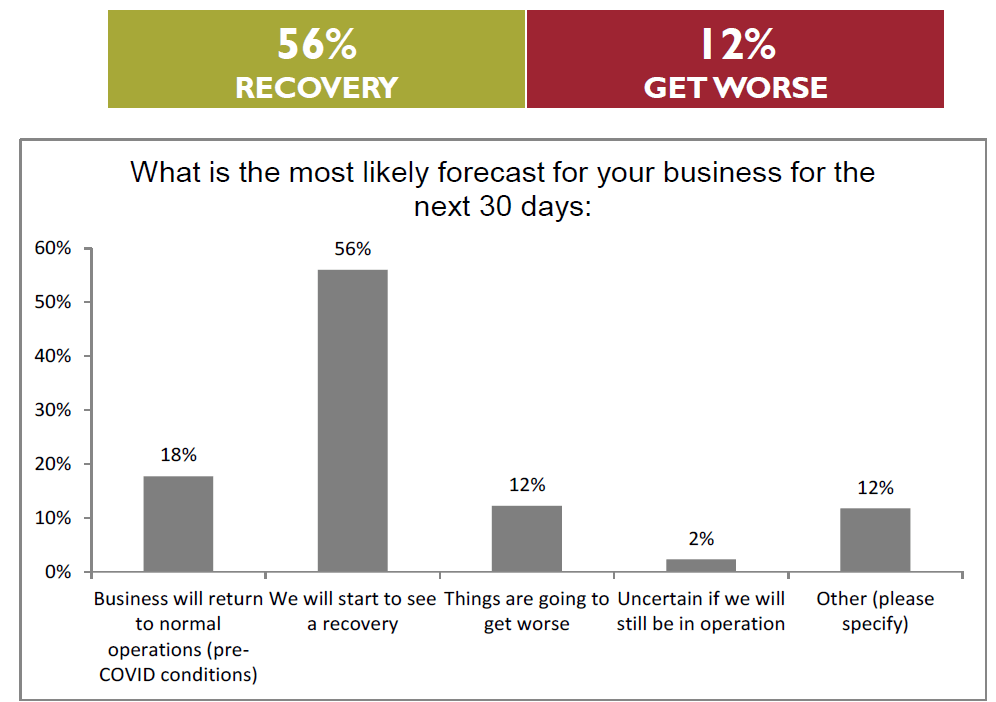

Compared to survey #1 results, confidence levels for improved business performance are fairly high. 56% of respondents expect to see a recovery, compared to 42% in the last survey. Similarly, 18% of respondents believe business will return to ‘pre-COVID conditions’, whereas only 6% indicated that in survey #1.

In the same vein, only 12% of respondents forecast that ‘things will get worse’ as compared to a sizeable 30% in the previous survey.

This comes with the caveat that the economy continues to gradually open up, vehicle usage increases, and demand returns.

The survey results indicate that while aftermarket businesses are fairly optimistic, they (12%) acknowledge that the business environment is still highly uncertain.

Majority of aftermarket businesses (91%) report that they are ‘very to slightly disrupted’, while only 1% are completely shutdown. A further breakdown of the disrupted numbers reveals that only 34% of businesses are ‘very disrupted’, whereas 57% of businesses are ‘slightly disrupted’. Only 1% of businesses had to ‘completely shutdown’.

Of the 8% of businesses that are ‘functioning normally’, 26% report revenue increase of 1-10% in May 2020; 28% forecast no changes to revenue in June 2020; and a further 44% forecast that revenue will remain unchanged for July 2020.

The consolidated response was consistent with the first round of surveys, but there is a considerably different picture when you drill down.

In survey#1, 61% of businesses reported as ‘very disrupted’, whereas in the current survey, the number drops by almost half as 34% of businesses report being ‘very disrupted’.

Similarly, in the ‘slightly disrupted’ category, the number climbs from 33% of businesses reporting slight disruption in survey #1 to 57% in survey #2.

The survey results clearly highlight that over half (57%) of respondents reported moderate to severe impact on their revenues in May 2020.

However, the numbers seem to stabilize for projections for June and July 2020. Only 13% of businesses forecast loss of revenue by 50% or more, where as 51% of businesses forecast revenue decrease between 1-40% for June 2020.

The responses for July 2020 indicate that while business confidence is climbing, a high level of uncertainty still persists. Roughly half of businesses (49%) still expect a decrease in revenue in the range of 1-30%.

The impact of reduced businesses seems to be stabilizing with less than half (47%) of businesses reporting laying off staff as compared to 61% of respondents in survey #1. Productivity is showing a slight improvement at 31%, along with fewer businesses (16%) reporting employees working from home. Another significant improvement for the sector is businesses (24%) being able to re-hire previously laid off staff. This may be due to the relief measures offered by the government which may help offset some of the HR related expenses.

The impact of reduced businesses seems to be stabilizing with less than half (47%) of businesses reporting laying off staff as compared to 61% of respondents in survey #1. Productivity is showing a slight improvement at 31%, along with fewer businesses (16%) reporting employees working from home. Another significant improvement for the sector is businesses (24%) being able to re-hire previously laid off staff. This may be due to the relief measures offered by the government which may help offset some of the HR related expenses.

Supply chain delays have increased slightly (68%) since the last survey in May 2020. A qualitative analysis of responses(13%) under this question indicate that supply chain delays are a low priority issue for most aftermarket businesses owing to the fact that most of them are not functioning at 100% capacity themselves.

Businesses do report delays in obtaining PPEs (personal protective equipment) given the increase in safety and sanitation practices. Open-ended comments also indicate that most delays on vehicle parts are from U.S. warehouses.

0 Comments