While overall Canadian automotive retail sales in Q1 2025 show sharp year-over-year fluctuations, industry observers caution that much of this volatility is rooted in atypical 2024 comparables—masking the more stable underlying trends in key segments like the automotive aftermarket retail numbers.

For example DesRosiers Automotive Consultants says, used vehicle sales are rebounding after a particularly weak Q1 in 2024, when new vehicle inventory finally recovered and months-long wait times largely disappeared.

That shift pulled many buyers back into new vehicle purchases, depressing demand—and prices—for used vehicles in early 2024. The apparent strength in 2025’s used vehicle sales is therefore more of a return to normalcy than new momentum.

Fuel sales tell a similar story. With pump prices having spiked in March 2024, the year-over-year dip seen in March 2025 reflects price movement rather than volume changes.

With average gas prices down from $1.698 per litre in April 2024 to $1.392 in April 2025—following the federal government’s removal of the carbon tax—gas station retail is expected to show weakness in Q2 as well.

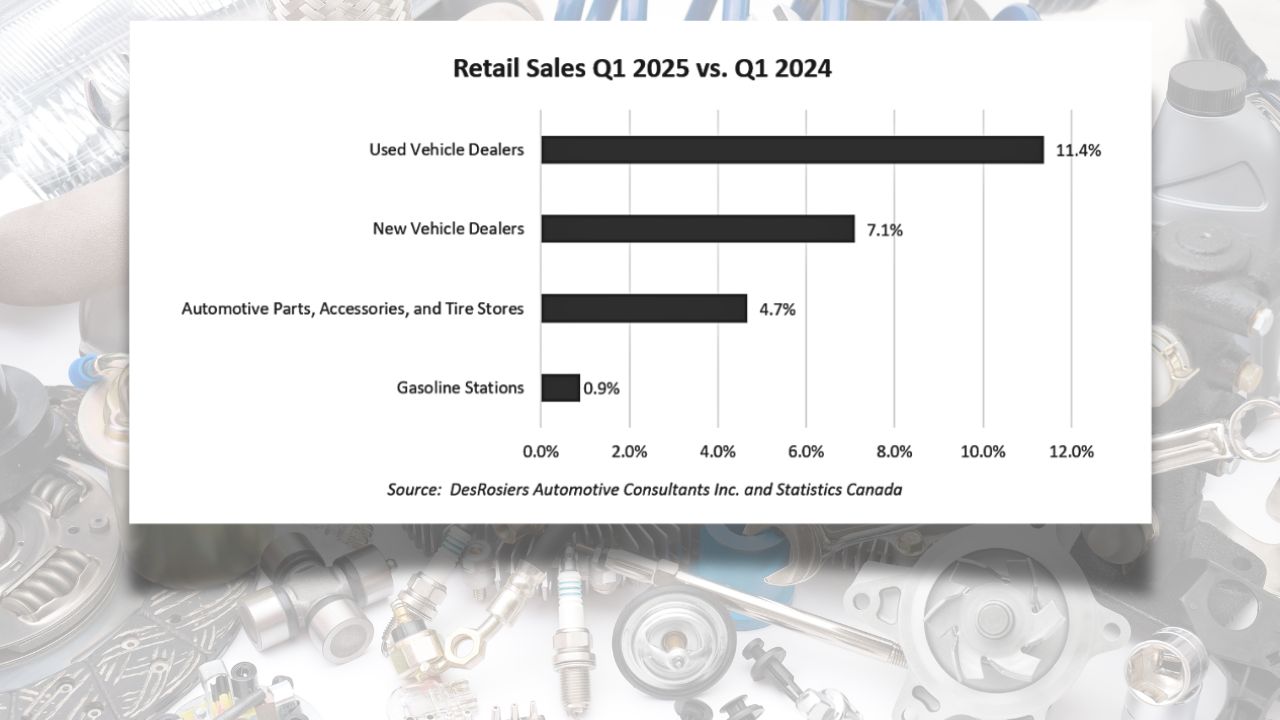

In contrast, two segments showing genuine growth are new vehicle dealers and the automotive aftermarket. New vehicle sales rose 7.1% in Q1, while aftermarket retail sales grew a solid 4.7%, reflecting sustained demand for parts, service, and accessories.

“This is a more reliable signal for the aftermarket,” said Andrew King, Managing Partner at DesRosiers Automotive Consultants. “While the hangover from 2024 complicates the 2025 retail sales numbers, looking forward the added complexity of the ongoing tariff chaos will impact prices—and sales—in the auto sector for the rest of 2025.”

King also noted that while U.S. trade tensions with Canada have temporarily cooled, the lack of long-term certainty continues to cloud pricing strategies and inventory planning throughout the supply chain.

For aftermarket businesses, the message is clear: Q1’s stable growth is encouraging, but market unpredictability—especially surrounding trade and pricing—remains a factor to watch through the remainder of the year.

0 Comments