Uni-Select Inc. today reported its financial results for the fourth quarter and the year ended December 31, 2020, with automotive aftermarket leading the way on rebound.

“By and large, our fourth-quarter results were in line with those of the previous quarter, ending a difficult year with a degree of stability. Sales for 2020 were down 15%, impacted by the global pandemic, but mirrored the trend in our three markets with a trough in the second quarter and a sharp bounce back in the second half of the year. As expected, automotive aftermarket businesses fared better than the refinish business in the U.S.,” stated Brent Windom, President and Chief Executive Officer of Uni-Select Inc.

“While our adjusted EBITDA followed a similar path, our adjusted EBITDA margin returned to normalized levels in the second half of the year, with our two automotive aftermarket businesses reporting 2020 margins superior to last year. We were able to achieve this by implementing stringent cost control measures and leveraging our continuous improvement culture which, this year alone, allowed us to generate an additional $30 million in annualized cost savings. These actions, coupled with tight management of our working capital, translated into strong cash flow from operations of $133 million for the year, which we used primarily to reduce our total net debt(1), in line with our capital allocation strategy.

“Looking forward, there remains a great deal of uncertainty related to the global pandemic, the Brexit overhang and ongoing structural changes in the refinish market in the U.S. With the visibility we have as of today, we expect our 2021 consolidated sales and adjusted EBITDA to progressively improve over 2020. During the year, we expect to ramp up certain capital investments to pre-COVID levels. We continue to be confident in the sustainability of our business and have the financial flexibility to execute our business plan,” concluded Windom.

All figures in CAD unless otherwise noted.

HIGHLIGHTS

Uni-Select Inc. Reports 2020 Fourth Quarter and Full Year Highlights and Financial Results:

• Effective cash management offsetting the effects of the COVID-19 pandemic (“COVID-19”) on operations and strengthening the financial position:

• Total net debt(1) reimbursement of $26.9 million in Q4 and $78.8 million for 2020;

• Positive free cash flows(1) of $15.8 million generated in Q4 and $72.3 million for 2020; and

• Available liquidity of $285.0 milllion as at December 31, 2020;

• Annualized savings of $33.0 million realized in 2020, mainly from the Continuous Improvement Plan;

• Consolidated sales down 11.2% in Q4 and 15.4% in 2020 impacted by COVID-19 and resulting in negative consolidated organic growth(1) of 12.0% for Q4 and 15.3% for 2020, each segment’s sales mirroring respective market and industry;

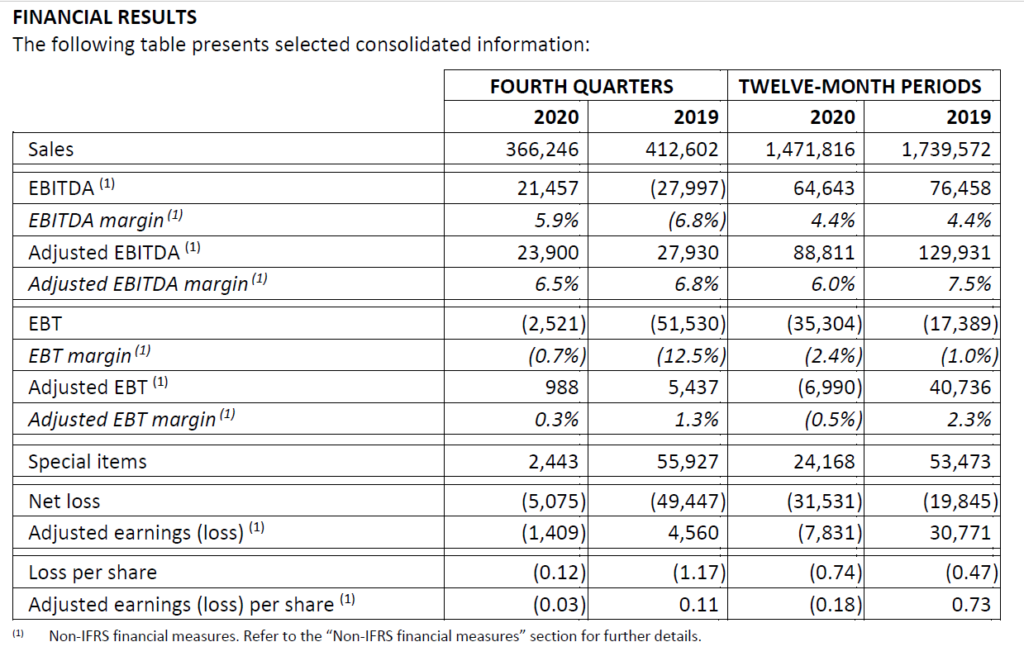

• EBITDA(1) of $21.5 million for Q4 and $64.6 million for 2020; adjusted EBITDA(1) and adjusted EBITDA margin(1) of $23.9 million or 6.5% for Q4 and $88.8 million or 6.0% for 2020; a marked adjusted EBITDA margin(1) improvement in the last half of 2020 in all segments; and

• EPS of $(0.12) for Q4 and $(0.74) for 2020; adjusted EPS(1) of $(0.03) for Q4 and $(0.18) for 2020.

UPDATE ON THE CONTINUOUS IMPROVEMENT PLAN (“CIP”)

The Corporation is pursuing a culture of continuous improvement, which is currently accelerated to be strategically positioned for recovery and growth post-COVID-19. This led to the CIP, announced on June 22, 2020, which was based on a long-term approach to further improve the productivity and efficiency of all segments, while ensuring that customer needs remain the focus.

The main objectives of the plan are to ensure that customers are served to the highest standards, that operations and service model are positioned to meet the long-term demands and expectations of the markets in which they operate, and that the Corporation continues to be a strong market leader, while ensuring a safe and healthy environment for all parties.

To accomplish these objectives, an in-depth review of operations was undertaken by each segment’s respective team, resulting in a number of key initiatives, including the way customers are served, rightsizing where required, automation and optimizing supply chain logistics. The CIP was initiated in June, and most initiatives were implemented during the third quarter.

As a result, the CIP was essentially completed for the Canadian Automotive Group and The Parts Alliance U.K. segments as at December 31, 2020. However, potential areas of optimization are currently under review by the FinishMaster U.S. segment, aiming to align the cost base with its evolving customer portfolio.

Through this plan, the Corporation was originally expecting to generate annualized cost savings of about $28.0 million to $30.0 million by the end of 2020, measured against the first quarter of 2020. As at December 31, 2020, annualized savings realized were $30.0 million, meeting expectations. These savings are mainly attributable to workforce reduction and the integration of 39 company-owned stores.

The total cash cost of implementing the CIP was expected to be $13.8 million, mainly for severance and closing costs as part of rightsizing activities. The Corporation also expected to write down certain assets of approximately $6.2 million. As at December 31, 2020, the Corporation recognized restructuring and other charges in relation to the CIP totalling $20.3 million, of which, $6.3 million is non-cash for the write-down of assets.

FOURTH QUARTER RESULTS

Consolidated sales of $366.2 million for the quarter decreased by 11.2% compared to the same quarter in 2019, impacted by COVID-19, resulting in negative consolidated organic growth of 12.0%. Organic sales mirrored the industry in each respective segment market, and reflected a similar pattern as observed in the third quarter, where negative organic growth of 12.6% was reported. Furthermore, consolidated sales were affected by the expected erosion resulting from the company-owned stores integrated over the last twelve months, as part of improvement plans. On the other hand, consolidated sales benefitted from favourable fluctuations of the British and the Canadian currencies, as well as from the contribution of business acquisitions.

The Corporation generated an EBITDA of $21.5 million for the quarter which was impacted by special items for restructuring and other charges related to the CIP of $1.8 million, as well as charges for the review of strategic alternatives of $0.6 million. Once adjusted, the EBITDA and the EBITDA margin were $23.9 million and 6.5%, respectively, compared to $27.9 million and 6.8% in 2019. The decrease of 30 basis points of the adjusted EBITDA margin, compared to the same quarter in 2019, is mainly explained by a lower absorption of fixed costs, a direct effect of the decrease in volume of sales, and lower vendor incentives resulting from the optimization of inventory, mainly in the FinishMaster U.S. segment.

These elements were partially compensated by savings realized as part of the CIP, from the workforce alignment and the integration of 45 company-owned stores (39 from the CIP and six from the Performance Improvement Plan or PIP) over the last twelve months, as well as cost-control measures put in place to face the pandemic and counteract the decrease in sales. Furthermore, the current quarter includes COVID-19 U.K. – specific government subsidies for occupancy costs of $1.0 million or about 20 basis points.

Net loss and adjusted loss for the current quarter were respectively $5.1 million and $1.4 million, compared to net loss of $49.4 million and adjusted earnings $4.6 million in 2019. Adjusted earnings (loss) decreased by $6.0 million compared to the same quarter last year, due to lower adjusted EBITDA and a different income tax rate.

Segmented Fourth Quarter Results

The FinishMaster U.S. segment reported sales of $154.7 million, a decrease of 22.0% from a corresponding negative organic growth, when compared to the same quarter of 2019, affected by COVID-19. Organic growth for the fourth quarter is similar to the trend observed during the third quarter; the refinish sector, being somewhat more discretionary, is not expected to recover at the same pace as the automotive parts business. This segment reported an EBITDA of $8.2 million for the quarter. Once adjusted for special items, EBITDA was $8.4 million or 5.4% of sales, compared to $16.4 million or 8.3% of sales in 2019.

The adjusted EBITDA margin decreased by 290 basis points mainly due to the lower volume of sales and gross profit, a reduction of the fixed costs absorption, as well as lower rebates in relation to the optimization of inventory, while being affected by an unfavourable evolving customer mix following the faster recovery from national accounts compared to traditional accounts. These elements were partially compensated by savings in relation to the CIP and the PIP, from the reduction of the workforce and the integration of 33 company-owned stores over the last twelve months. As well, the quarter benefitted from a reduction of discretionary expenses. Even though the fourth quarter is seasonally weaker in sales, this segment succeeded in generating a higher adjusted EBITDA than the third quarter through tighter controls over operating expenses and the CIP.

The Canadian Automotive Group segment reported sales of $124.9 million, which increased by 2.1% compared to the corresponding quarter of 2019, driven by the contribution of business acquisitions and the appreciation of the Canadian dollar during the current quarter of 2020. This segment reported a minimal negative organic growth of 0.1% for the quarter, the performance of the distribution centres selling to independent customers being mitigated by sales to installers, as the network of stores is more sensitive to the effects of COVID-19. Overall, the second semester was positive for this segment, which was able to maintain its level of sales, compared to the prior year, despite the challenging context of the COVID-19 pandemic. This segment reported an EBITDA of $12.7 million for the quarter. Once adjusted for special items, EBITDA was $13.4 million or 10.7% of sales, compared to $9.2 million or 7.6% of sales in 2019. The adjusted EBITDA margin increased by 310 basis points, benefitting from savings in relation to the workforce alignment as part of the CIP, as well as a favourable timing of vendor rebates. In addition, foreign exchange gains were recorded during the current quarter, as opposed to losses in 2019, representing a variance of about 170 basis points. For the second quarter in a row, this segment reported an improved adjusted EBITDA margin compared to the corresponding quarter last year.

The Parts Alliance U.K. segment reported sales of $86.7 million, representing a decrease of 5.8% compared to the same quarter in 2019. Sales were affected by COVID-19 since the end of the first quarter, resulting in negative organic growth of 6.0%, as well as by the expected erosion resulting from the integration of company-owned stores within the last twelve months. The strengthening of the British pound against the US dollar partially compensated the decrease by 2.3%. The organic growth of the fourth quarter was slightly below the negative 5.3% reported for the third quarter, as the U.K. entered the second wave of COVID-19 and associated government-imposed lockdown. This segment reported an EBITDA and an adjusted EBITDA of $6.7 million or 7.8% of sales for the quarter, compared to $5.1 million or 5.6% of sales and $5.2 million or 5.7% of sales respectively in 2019. The adjusted EBITDA margin increased by 210 basis points principally from savings related to the CIP, mostly from the rightsizing of the workforce, as well as reduced spending. The current quarter also benefitted from governmental occupancy subsidies amounting to $1.0 million, offsetting the reduced fixed costs absorption due to the lower level of sales. This is the second quarter in a row that this segment is reporting an improved adjusted EBITDA, in both dollars and percentage of sales, compared to last year, despite the decline in sales.

TWELVE-MONTH PERIOD RESULTS

Consolidated sales of $1,471.8 million for the year decreased by 15.4% compared to 2019. This performance is largely attributable to negative organic growth of 15.3% impacted by COVID-19 and, to a lesser extent, the expected erosion resulting from the integration of company-owned stores over the last twelve months, as well as the unfavourable fluctuation of the Canadian currency. These elements were partially compensated by the contribution of one additional billing day and business acquisitions.

The Corporation generated an EBITDA of $64.6 million for the year, impacted by special items for restructuring and other charges related to the CIP of $21.5 million, as well as charges for the review of strategic alternatives of $2.7 million. Once adjusted, the EBITDA and the EBITDA margin were $88.8 million and 6.0%, respectively, compared to $129.9 million and 7.5% in 2019. The adjusted EBITDA margin decreased by 150 basis points, compared to 2019, affected by a lower absorption of fixed costs, a direct effect of the decrease in volume of sales, and lower vendor incentives resulting from the optimization of inventory, mainly in the FinishMaster U.S. segment. Furthermore, the twelve-month period was impacted by additional reserves for inventory obsolescence and bad debt of $7.7 million. These elements were partially compensated by savings realized as part of the CIP, from the workforce alignment and the integration of company-owned stores, as well as cost-control measures put in place to face the pandemic and counteract the decrease in sales. Furthermore, the 2020 year benefitted from COVID-19-related governmental subsidies of $6.0 million.

Net loss and adjusted loss for the year were respectively $31.5 million and $7.8 million, compared to net loss and adjusted earnings of $19.8 million and $30.8 million in 2019. Adjusted earnings (loss) decreased by $38.6 million compared to last year, due to lower adjusted EBITDA, as explained above, higher interest rates, the loss on debt extinguishment of $3.1 million following the conclusion of a new credit agreement on May 29, 2020, as well as a different income tax rate.

Segmented Twelve-Month Period Results

The FinishMaster U.S. segment reported sales of $653.7 million for the year, a decrease of 21.3% compared to 2019, and a corresponding negative organic growth, mainly affected by COVID-19 since the end of the first quarter. This segment reported an EBITDA of $24.5 million for the period. Once adjusted for special items, EBITDA was $32.9 million or 5.0% of sales, compared to $73.1 million or 8.8% of sales in 2019. The adjusted EBITDA margin decreased by 380 basis points due to the lower volume of sales and gross profit, a reduction of the fixed costs absorption, as well as lower rebates in relation to the optimization of inventory, while being affected by an unfavourable evolving customer mix related to national accounts, which are recovering faster than the traditional accounts. Furthermore, the twelve-month period was impacted by additional reserves for inventory obsolescence and bad debt totalling about $3.6 million. These elements were partially compensated by savings in relation to the CIP and the PIP, from the reduction of the workforce and the integration of company-owned stores over the last twelve months. As well, the year benefitted from furloughs and the reduction of working hours, as part of measures to face the pandemic, predominately during the second quarter.

The Canadian Automotive Group segment reported sales of $485.4 million for the year, a decrease of 6.0%, compared to 2019, reflecting the effect of COVID-19, which resulted in a negative organic growth of 6.2%, as well as the depreciation of the Canadian currency. These elements were partially compensated by the contribution of business acquisitions and one additional billing day. This segment reported an EBITDA of $41.3 million for the year. Once adjusted for special items, EBITDA was $48.0 million or 9.9% of sales, compared to $47.2 million or 9.1% of sales in 2019. The adjusted EBITDA margin improved by 80 basis points, compared to 2019, benefitting from savings related to the CIP, measures to counteract the COVID-19 pandemic during the second quarter, including staff furloughs, the reduction of working hours and discretionary expenses, as well as from governmental payroll subsidies recognized during the third quarter. These elements compensated for the loss of income from the ProColor banner program and additional volume rebates and incentives in 2019, which did not occur this year. Additionally, 2020 margins were affected by a lesser absorption of fixed costs resulting from the decrease in volume of sales and additional bad debt expense.

The Parts Alliance U.K. segment recorded sales of $332.7 million for the year, a decrease of 15.3% compared to last year, mainly affected by COVID-19 since the end of the first quarter, resulting in negative organic growth of 14.5% and the expected erosion resulting from the integration of company-owned stores within the last twelve months. These elements were partially compensated by a favourable variance in the number of billing days and the strengthening of the British pound. This segment reported an EBITDA of $15.2 million for the period. Once adjusted for special items, EBITDA was $20.4 million or 6.1% of sales compared to $22.0 million or 5.6% of sales last year. The adjusted EBITDA margin for 2020 increased by 50 basis points, compared to last year, driven by savings from the CIP and measures put in place to face COVID-19, such as staff furloughs, reduction of working hours and reduced spending. In addition, the segment benefitted from governmental occupancy subsidies amounting to $2.5 million. These elements were partially offset by additional reserves for inventory obsolescence and bad debt recorded during the second and third quarters, a lower absorption of fixed costs and a lower level of rebates due to reduced purchase levels.

CONFERENCE CALL

Uni-Select will host a conference call to discuss its fourth-quarter and annual results for 2020 on February 19, 2021, at 8:00 AM Eastern. To join the conference, dial 1 866 865-3087 (or 1 647 427-7450 for international calls).

A recording of the conference call will be available from 11:30 AM Eastern on February 19, 2021, until 11:59 PM Eastern on March 19, 2021. To access the replay, dial 1 855 859-2056 followed by 8291097.

A live webcast of the quarterly results conference call will also be accessible through the “Investors” section of our website at uniselect.com where a replay will also be archived. Listeners should allow ample time to access the webcast and supporting slides.

0 Comments